“The extent of the market’s shrinkage in 2020-21 should have served to dispel an illusion that had been gaining ground during the past decade. This was that leading common stocks could be bought at any time and at any price, with the assurance not only of ultimate profit but also that any intervening loss would soon be recouped by a renewed advance of the market to new high levels. That was too good to be true. At long last the stock market has “returned to normal,” in the sense that both speculators and stock investors must again be prepared to experience significant and perhaps protracted falls as well as rises in the value of their holdings.”

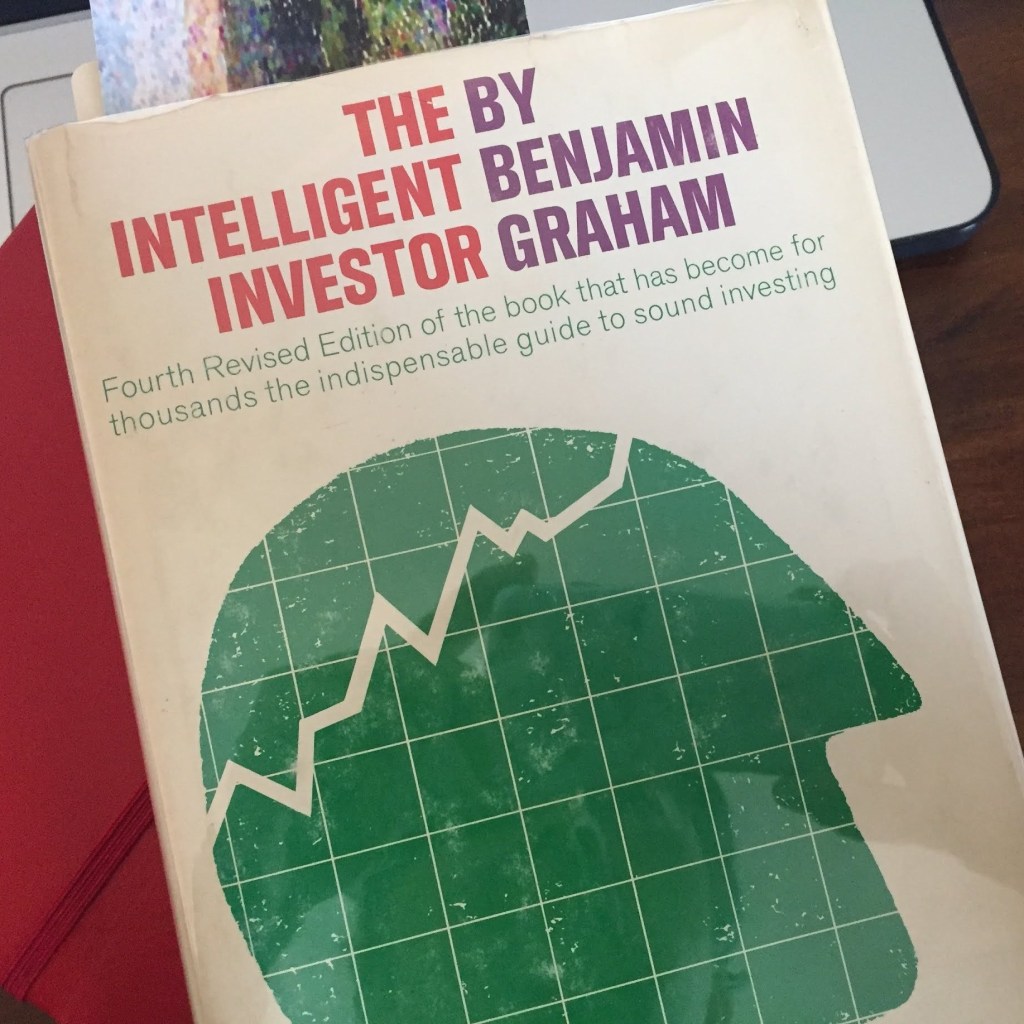

Actually, that’s mostly Ben Graham, save for a couple changes—one very obvious and another slightly subtle, but that quote is an excerpt from the introduction of the fourth edition of his seemingly timeless book, “The Intelligent Investor” published in 1973. The two changes made were only to the first sentence: 1969-70 was the original date range and “past decade” was originally “past two decades.”

I want to stress that the 4th edition and all other editions are still worthwhile annual reads as they are packed with priceless reminders for the average investor looking to avoid psychological pitfalls that keep them from achieving long-term capital gains.